Why Invest Sharia

Our Mission

At Invest Sharia, we’re dedicated to enhancing the financial lives of Muslims and ethical investors worldwide. We provide investment solutions that resonate with Islamic principles, ensuring your investments align with your core beliefs.

Accessibility for All

Whether you’re starting fresh or transferring from an ISA, pension scheme, life insurance bond, or trust, our portfolios are designed for seamless integration. We’ve partnered with multiple platforms to ensure you have easy access to our investment solutions.

Liquidity You Can Trust

We understand the importance of liquidity in investments. With Invest Sharia, you have the freedom to withdraw or move your funds whenever you wish, without any lock-in periods. Whether your circumstances change or you seek different investment avenues, we’re here to support your choices.

Flexibility in Investments

Our portfolios are dynamic. We continuously adjust to market conditions, ensuring your investments are always in a position to capitalize on market growth or safeguard against potential downturns. From financial downturns like the 2008 crash to unexpected events like the 2020 COVID-19 impact, we ensure your investments are managed with utmost care.

Risk Management with Precision

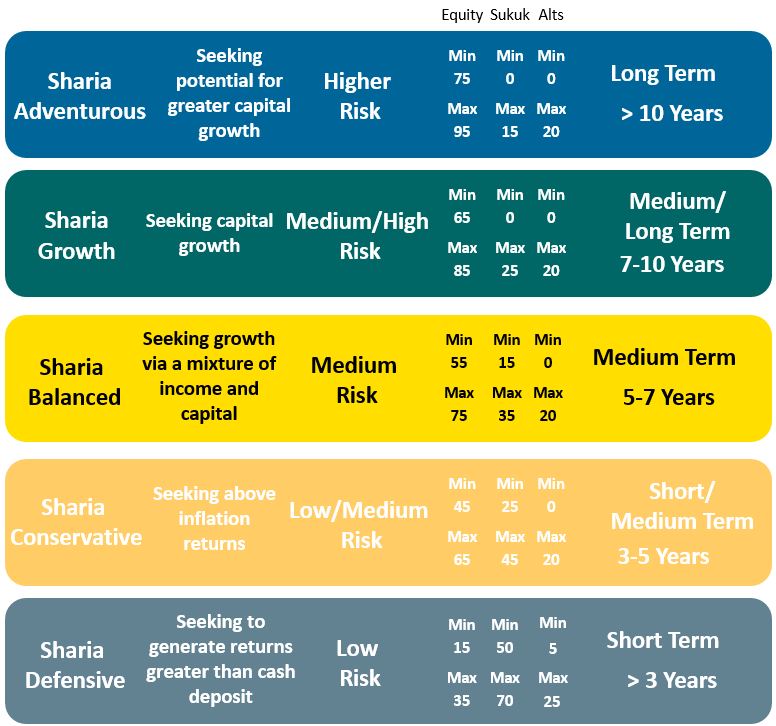

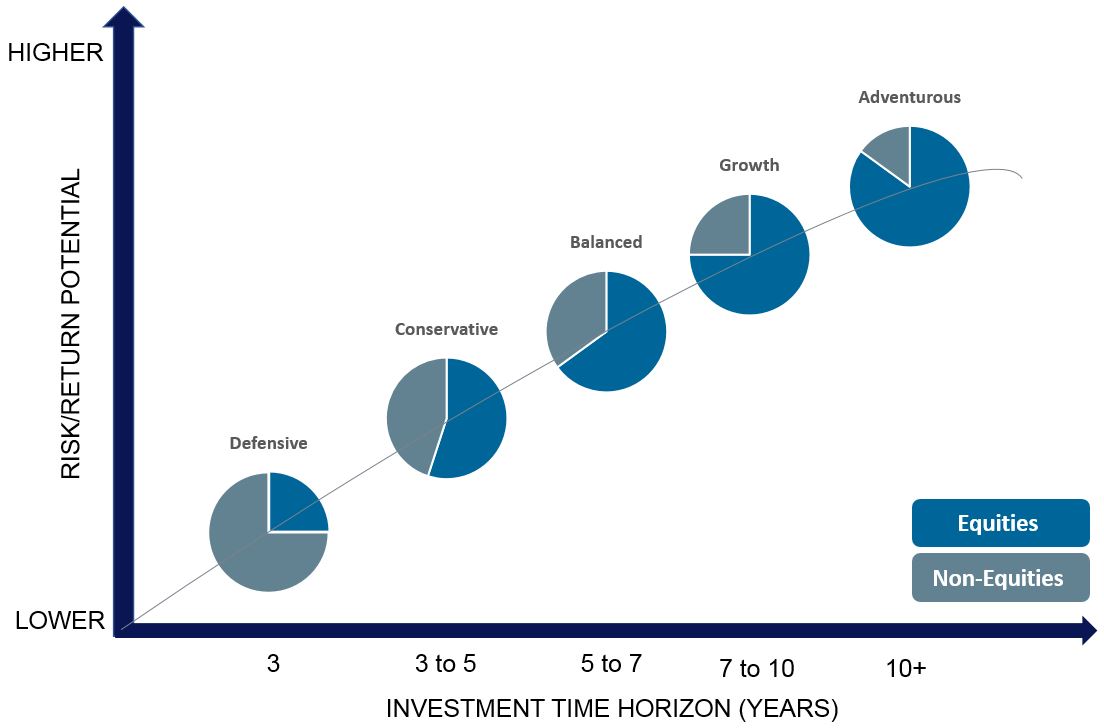

Our diverse range of portfolios caters to various risk appetites. Whether you’re a conservative investor or someone seeking aggressive growth, our strategies are tailored to your needs.

(Note: The provided chart offers a glimpse into our risk management approach.)

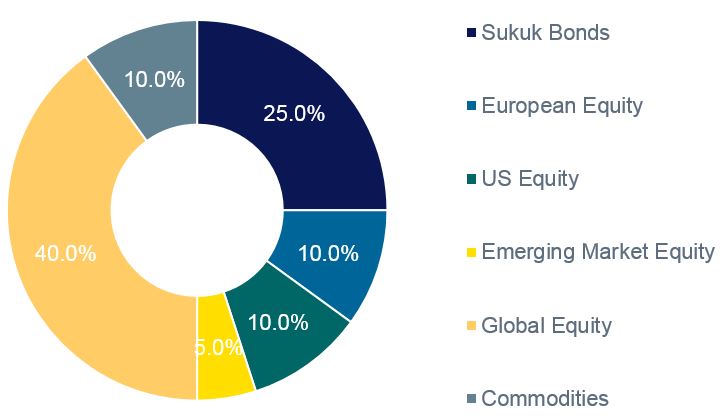

Diversification for Stability

At Invest Sharia, we believe in spreading risk. Our portfolios are diversified across asset classes, regions, and underlying funds, ensuring a balanced approach to halal investing.

(Note: The provided chart showcases our diversification strategy for the Sharia Balanced Portfolio.)

Capital Preservation – Our Priority

Protecting your capital is our primary goal. Through active portfolio management, we minimize potential losses during challenging market phases, setting the stage for robust recoveries in subsequent market upturns.

(Note: The provided illustration depicts the performance stability of the Invest Sharia Balanced Fund in comparison to its benchmark for 2020.)